The UK is now the leading electric vehicle market in Europe, says energy and commodity analyst BloombergNEF.

The BloombergNEF Electric Vehicle Outlook 2025 report reveals that UK EV uptake is accelerating faster than the global average, and expected to hit 64% of passenger vehicle sales by 2030, compared with 42% globally.

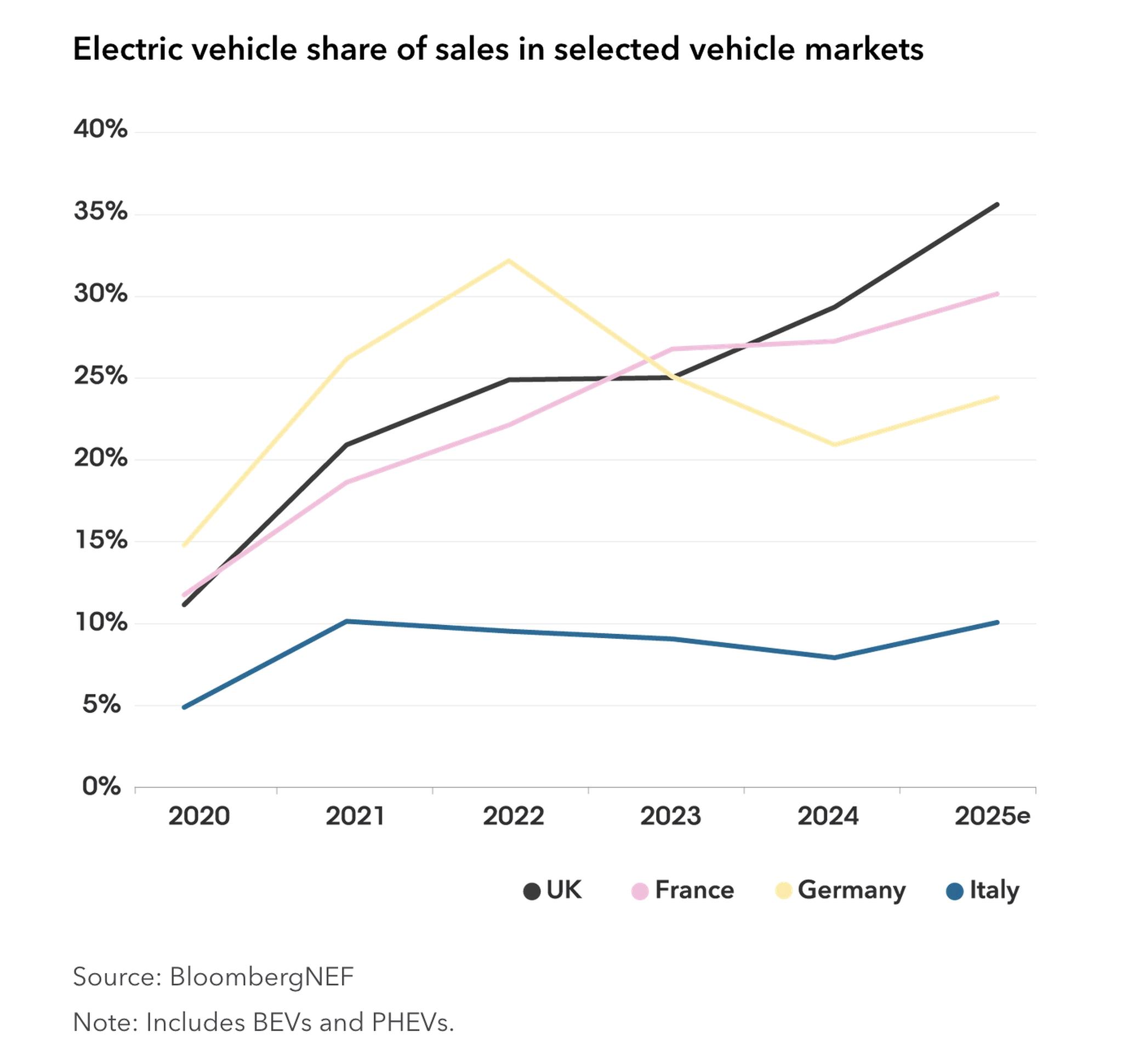

In 2024, EVs made up 29% of passenger vehicle sales in the UK, ahead of France (27%) and Germany (13.9%).

UK EV growth is driven by the UK’s Zero Emission Vehicle (ZEV) Mandate and openness to Chinese automakers, with EVs projected to reach 35% of UK car sales by 2025 and 40% in 2026.

BloombergNEF predicts that EVs will account for 20% of UK electricity demand by 2040 – nearly double the global average (11% by 2050).

Despite UK residential electricity among the most expensive in Europe (up 42% since the end of 2020), UK EV drivers still save $387 (£287) average per year compared petrol and diesel.

However, UK EV public charging costs are the highest in Europe, with drivers paying $400 (£297) to $900 (£668) more per year depending on charger speed compared with gasoline.

Global sales of electric vehicles are set for another record-breaking year as costs of lithium-ion batteries fall and production of more affordable models ramps up. Plug-in electric vehicles are set to account for one in four vehicles sold globally this year, a remarkable growth from just a few years ago when less than 5% of global vehicle sales were electric vehicles.

BloombergNEF’s Electric Vehicles Outlook expects almost 22 million global passenger EV sales this year, a jump of 25% from 2024, as the cost of lithium-ion batteries falls and production of more affordable EV models ramps up.

China accounts for nearly two-thirds of global EV sales, followed by Europe at 17% of sales and the US at 7%. Emerging markets, meanwhile, are growing rapidly due to sales from Chinese automakers.

China’s annual EV sales are set to surpass total US new vehicle sales of any type in the next year.

Due to a shifting US regulatory environment, BNEF has reduced its short and long-term outlook for global passenger EV adoption for the first time.

Electricity costs to refuel EVs are rising quickly in some markets. The affordability of vehicles and charging remains critical for EV adoption and sales in the long-term.

Despite the global growth of EV sales, BNEF has reduced its long-term and short-term passenger EV adoption outlook for the first time largely due to the various policy changes in the US. The roll-back of federal fuel-economy standards, the phase-out of the EV tax credit and the potential removal of California’s ability to set its own air quality standards, result in a notable decline in EV adoption in the US, impacting global adoption rates. While passenger EV sales in the US are still projected to rise – from 1.6 million in 2025 to 4.1 million in 2030 – the revised outlook falls short of previous BNEF projections, resulting in 14 million fewer cumulative EV sales over that period.

China extends its lead over Europe and the US as it is the only country where EVs are on average cheaper to buy than comparable ICE vehicles. Demonstrating China’s dominance further, the report finds that 69% of EVs sold globally in 2024 were manufactured in China, with Chinese automakers having a major presence in EV sales in emerging markets like Thailand and Brazil. These sales, paired with an evolving policy landscape in the US, has put adoption in some emerging markets, like Thailand, higher than in the US, challenging the widely held assumption that EVs will start in wealthy countries before spreading further. Outside of China, the UK leads among major car markets and holds the top spot for EV adoption among large countries in Europe, ahead of Germany.

Drawing on BNEF's team of sectoral and regional experts globally, the report presents two updated road transport scenarios.

In the base case Economic Transition Scenario (ETS) – in which EV adoption is shaped by current techno-economic trends and with no new policy intervention – EVs reach 56% of global passenger vehicle sales by 2035 and 70% by 2040, down from 73% in the previous outlook.

Despite rapid EV adoption, only 40% of the global passenger-vehicle fleet is electric by 2040 in the ETS, far below what is required to keep road transport emissions on track for the Net Zero Scenario.

Colin McKerracher, head of clean transport and energy storage at BloombergNEF, and lead author of the report said: “2024 was a landmark year for electrified transport, with electric vehicles hitting global sales highs and rapidly increasing adoption from emerging markets across Asia and LatAm. Despite these positive tailwinds, we see slower EV adoption in the short and long-term due in large part to the changing landscape in the US. This shift in global adoption will also have major impacts on the battery industry, leading to overcapacity in manufacturing.”

The report finds that while battery demand for EVs is still growing, it is lower than in previous outlooks. BNEF’s battery demand outlook between 2025 and 2035 fell 8% compared to last year’s, equating to 3.4 terawatt-hours fewer batteries – a majority of which (2.8TWh) can be attributed to decreasing passenger EV sales in the US. This dynamic is leading to continued overcapacity, driving battery costs lower and intensifying market competition.

In China, average utilisation of battery plants is now below 50%. Despite a near-term slowdown, the long-term growth for battery metals remains strong as EVs are adopted more quickly across all segments.

The cost of public EV charging also poses a challenge to widespread EV adoption. While the majority of EV drivers today are heavily reliant on home charging, which is typically 25% to 60% cheaper than gasoline on a per-kilometre-driven basis, public EV charging costs remain high. Public fast charging prices have risen sharply since 2022, especially in the US and Europe, pushing costs per kilometre above petrol in some cases. As a result, refuelling costs are expected to have a growing impact on EV adoption and price parity between EVs and ICE vehicles past the point of sale over time.?"Despite significant leaps in EV adoption globally, stable and comprehensive policy still matters in advancing it further, said Aleksandra O’Donovan, head of electric vehicles at BNEF. “Automakers that lose sight of the longer-term trend towards electrification – supported by falling battery prices and improving economics of EVs – risk being squeezed out of the major car markets."

The 2025 Electric Vehicle Outlook reports:

BloombergNEF is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy.

TransportXtra is part of Landor LINKS

© 2025 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020