The latest local government revenue and expenditure returns highlight that total parking gross revenues exceeded £2bn in 2024/5 of which over £1bn was taken in on-street revenues by London boroughs. As usual, Westminster was the top earner with gross revenues of £125m. Which was higher than the total for all the Metropolitan districts in England. But just seven local authorities outside London netted more than £10m in parking revenues, highlighting that it is not the money spinner that many people assume.

The Ministry of Housing, Communities and Local Government (MHCLG) local government finance returns (Revenue Outturn 2024-25: Highways and Transport Services (RO2) data) include parking expenditure and revenue. Published alongside the annual data is a time-series dataset covering the last eight years.

Gross parking revenue across nearly all English local authorities (data from some councils (e.g. Birmingham), is missing from the analysis) totalled £2.3bn in 2024/25, with net revenue just under £1.2bn. These figures exclude capital costs and depreciation, which are particularly relevant for off-street parking provision. Revenues include income from parking charges, penalty charge notices (PCNs), and parking permits. Operational costs only reflect day-to-day running expenses.

Table 1 provides a high-level summary of revenue by type of council. As can be seen, London dominates on-street parking, accounting for 69% of gross and 79% of net revenues. While across both on and off-street parking, London accounts for 54% of net revenues. Westminster is poised to become the first council to net £100m from parking charges, nearly matching its Council Tax revenue of £105m highlighting the importance of parking revenue to the council.

Table 2 highlights the top ten London grossing councils. It is notable that there are large differences in the cost of parking operations between the councils. Kensington & Chelsea report operating costs of just £13m, half of Islington’s £26m. Across London, based on London Council’s enforcement data, PCNs alone will have brought in, in excess of £250m. Amongst the Metropolitan Districts only Manchester and Newcastle netted more than £10m, while for most councils parking revenues is relatively small change (Table 3). Amongst the other local authorities, there are few (e.g. Brighton) where parking revenues are significant, but there are only six that net more than £10m a year (Table 4).

While the London boroughs dominate on-street parking revenue, the top off-street parking revenue generators are a very varied mix of authorities (Table 5). Ranging from more tourist locations to major cities. A number of local authorities have disposed of their off-street parking assets due to the cost of maintenance and increased land values making alternative uses more attractive.

MHCLG has also released a time-series dataset this year, providing a consistent view of parking revenues over the past eight years. To ensure comparability across years, the data has been cleaned to account for local government reorganisations and missing returns. As a result, the aggregate figures in this dataset do not align precisely with those presented earlier. All values have been adjusted to 2024/25 prices using the Consumer Price Index, enabling meaningful year-on-year comparisons.

Total net parking revenue has remained broadly stable across the eight-year period, with the notable exception of the pandemic years (Table 6). In the first year of the pandemic, net revenue fell by £600m but recovered relatively quickly. Nevertheless, revenues in 2024/25 remain slightly below those recorded in 2018/19.

London was comparatively resilient during the pandemic, likely due to the continued income from residents’ parking permits. By 2024/25, London’s net revenue had risen to around 10% above pre-pandemic levels.

In contrast, the other local authority groups experienced a total collapse in parking revenue turning surpluses to deficits. While revenues have recovered they remain below pre-pandemic levels across all authority types.

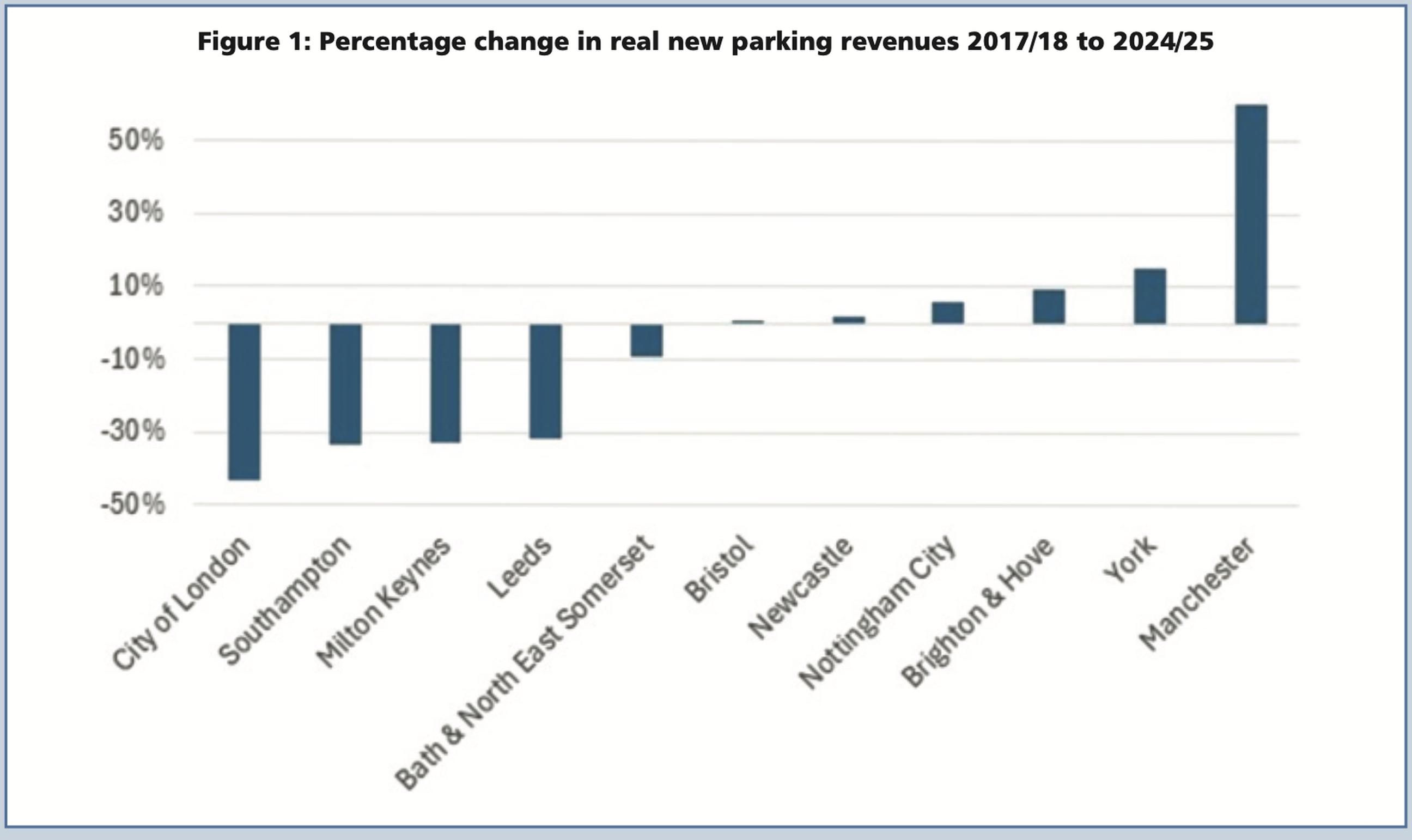

However, individual authority performance has varied considerably. Figure 1 looks at how net parking revenues have changed in real terms between 2017/18 and 2024/24 for those local authorities outside Greater London with the highest net revenues in 2017/18 plus the City of London.

The City of London has seen a 43% fall in real revenues as the large reduction in business travel and increased working from home has had an impact. Other cities have been hit by weakened retail performance and working from home, while more tourist locations like Brighton and York have seen growth in revenues. However, Manchester is the standout location possibly benefiting from its strongly performing economy.

For a small number of local authorities, primarily in London, parking remains a significant revenue stream. But for the majority, it’s more of a millstone: politically contentious and, in some cases, financially burdensome. Parking income is shaped by the strength of local retail and leisure sectors, council pricing strategies, and supply-side decisions. Yet all three are under pressure. The decline of bricks-and-mortar retail, the rise of remote working, and the fall in business travel are steadily eroding demand and with it, local authority revenues.

Parking also carries a substantial opportunity cost. Is road space better used for the movement of people and goods? Could land tied up in off-street parking deliver greater economic or social value through redevelopment? However, to date, there’s been no serious, coordinated effort to push the public sector to exit the off-street parking business, unlike the push to withdraw from direct public transport provision.

And yet the numbers are compelling. Simply retaining off-street sites for parking but selling them off to the private sector could unlock between £4bn and £8bn in capital receipts, money that cash-strapped councils could redeploy elsewhere. In a market that appears stagnant, the real question for many councils is no longer how to maximise parking revenue, but whether parking itself is the best use of public land from a wider economic and social perspective.

Note on the data

All data is from Ministry of Housing, Communities and Local Government (MHCLG) local government finance returns (Revenue Outturn 2024-25: Highways and Transport Services).

John Siraut is director of Transport Economics at Fortia Insight, an RSK company.

https://fortiainsight.com

TransportXtra is part of Landor LINKS

© 2026 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020