The Office for Budget Responsibility (OBR) is an independent body that produces detailed five-year forecasts for the economy and public finances. Its fiscal reviews incorporate the impact of any tax and spending measures announced in Budget statements made by the Chancellor of the Exchequer.

The OBR’s review of chancellor Rachel Reeves’ November 2025 Budget included analysis of the likely impacts of measures related to electric vehicles, extracted below:

The government has announced changes to the taxation of and subsidies for electric vehicles (EVs). The most significant is the introduction of a new mileage-based charge on electric cars, additional to the current vehicle excise duty (VED) charges paid by all vehicles, which will be introduced in April 2028. In 2028-29, the charge will equal £0.03 per mile for battery electric cars and £0.015 per mile for plug-in hybrid cars, with the rate per mile increasing annually with CPI.

The average driver of a battery electric car in 2028-29 driving 8,500 miles is therefore expected to be charged £255 in this year. This is roughly equivalent to half the rate of fuel duty tax paid per mile by drivers of petrol and diesel vehicles.

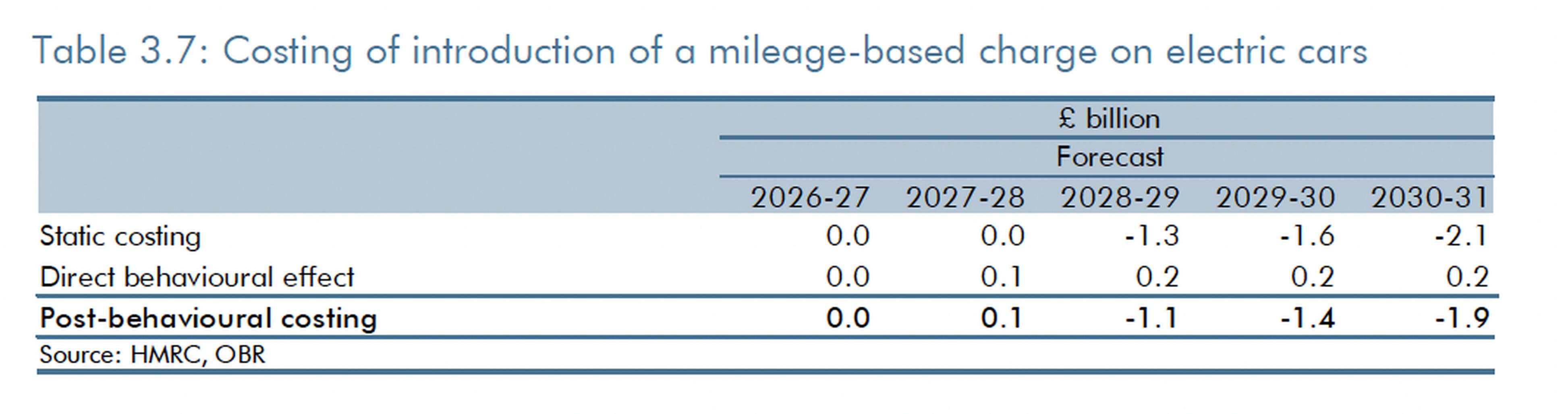

The new charge is expected to raise £1.1bn in 2028-29, rising to £1.9bn in 2030-31 (see Table 3.7). The yield from the measure is uncertain as it dependent on the uptake of electric vehicles over the next five years. The government’s zero-emission vehicle (ZEV) mandate requires EVs to make up an increasing minimum proportion of total manufacturer sales over the next five years, reaching 80% in 2030. This new charge is likely to reduce demand for electric cars as it increases their lifetime cost. To meet the mandate, manufacturers would therefore need to respond through lowering prices or reducing sales of non-EV vehicles.

Overall, as a result of this measure, we estimate there will be around 440,000 fewer electric car sales across the forecast period relative to the pre-measures forecast, with 320,000 of this offset by the expected increase in sales due to other Budget measures described below. This behavioural response to the policy, along with a small expected reduction in the average mileage of an electric car, is expected to reduce the yield by around £0.2 billion by 2030-31.

The government has also announced a set of measures designed to increase the incentive to purchase electric vehicles. These are considered in the estimated behavioural response to the new mileage-based charge on electric cars, set out above. An increase to the expensive car supplement (ECS) threshold for battery electric cars, from £40,000 to £50,000 in April 2026, costs £0.5 billion in 2030-31.

The ECS is an additional VED charge which is spread over five years, commencing a year after the vehicle is first registered, totalling £2,370 for a car purchased in 2025-26. The government has also expanded the electric car grant between 2025-26 and 2029-30 at an average cost of £0.3 billion in these years.

Vehicle excise duty (VED) receipts are expected to raise £9bn in 2025-26, a 15% increase compared to 2024-25. This is due to an increase in vehicle registrations and the impact of VED reforms from previous Budgets which took effect in April 2025.

Receipts prior to the impact of measures are forecast to increase to £12bn by 2030-31, mainly as a result of RPI upratings of VED rates and increases in revenue from the expensive car supplement due to frozen thresholds. Relative to the March forecast, prior to the impact of measures, receipts are expected to be £0.5bn higher in 2029-30 due to stronger in-year receipts and registrations data resulting in an increase in the new car sales forecast.

The Budget policy to introduce a new annual mileage-based charge on battery and plug-in hybrid electric cars increases VED receipts by around £1.5bn a year from 2028-29.

Government policy measures announced since March are expected to decrease inflation by 0.3 percentage points in 2026 (a peak quarterly impact of 0.5 percentage points in the second quarter of 2026), primarily reflecting the impact of measures that reduce household energy bills and the fuel duty freeze extension. We then expect government policy to add 0.1 percentage points to CPI inflation in 2028, due to the new VED charge on electric vehicles in April 2028.

Office for Budget Responsibility, Economic and fiscal outlook, November 2025

TransportXtra is part of Landor LINKS

© 2026 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020