The government is to introduce a new mileage charge for electric and plug-in hybrid cars, chancellor Rachel Reeves confirmed in her Budget.

The Electric Vehicle Excise Duty (eVED) will take effect from April 2028.

The eVED scheme will require drivers of electric cars to estimate the mileage they expect to travel and pay either annually or monthly. The actual distance travelled will then be reconciled at the year end. The scheme will be administered by DVLA and apply only to cars.

Motoring taxation is currently structured around two elements: taxation on the usage of the vehicle (primarily via fuel duty) and taxation on the ownership of the vehicle (primarily via Vehicle Excise Duty).

While drivers of petrol and diesel vehicles are subject to taxation on usage via fuel duty at the pump, HM Treasury says that drivers of electric vehicles do not currently pay an equivalent. If left unchanged, the government predicts that by 2030 around 1 in 5 car drivers will pay no fuel duty equivalent, in contrast to other drivers who currently contribute an average of £480 a year.

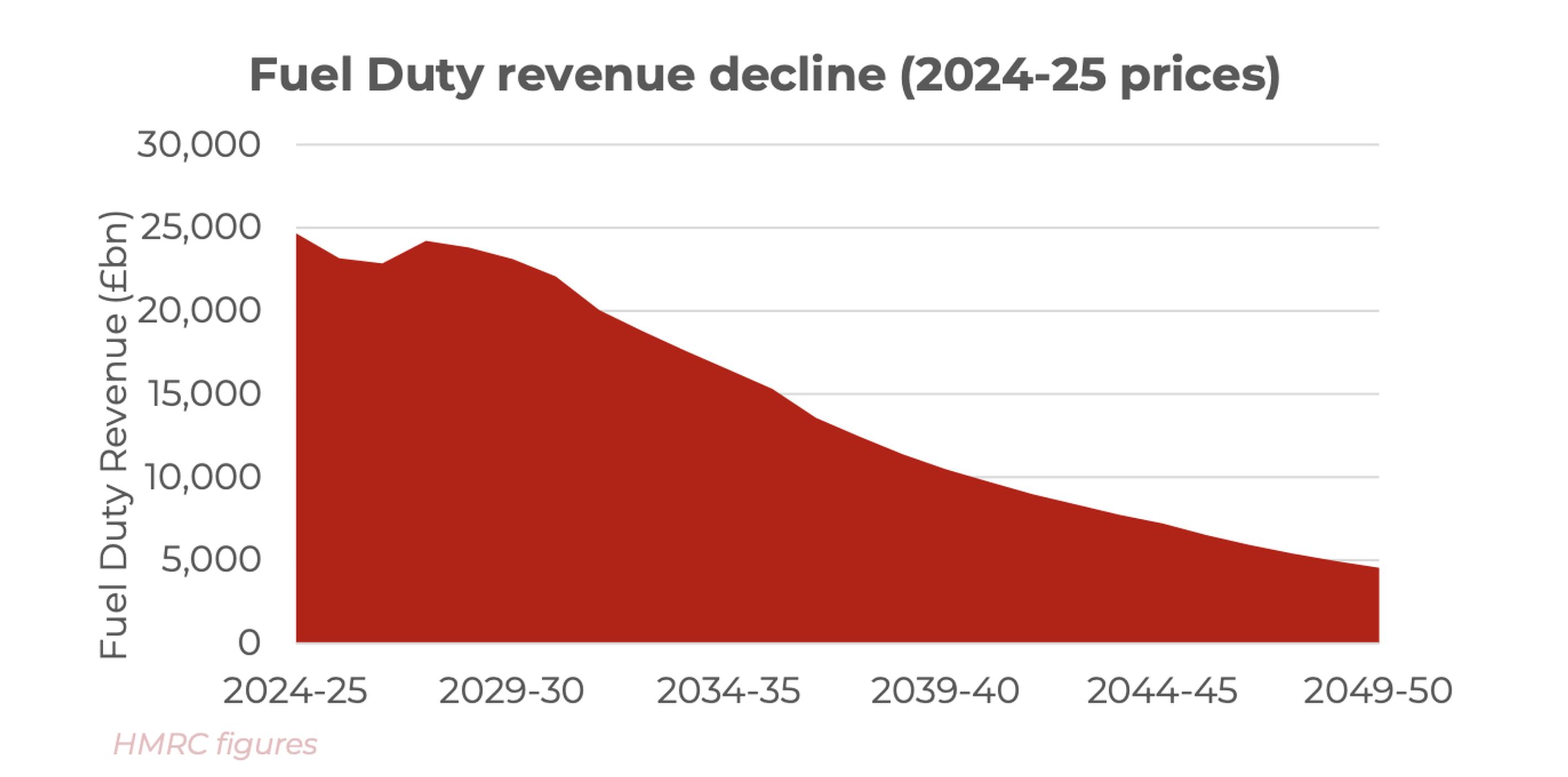

The eVED proposal is designed to achieve fiscal sustainability in a changing landscape. As the share of electric vehicles rises and overall petrol and diesel consumption falls, the Office of Budgetary Responsibility (OBR) has forecast that fuel duty revenues (~£24bn in 2024-25) will decline to around half current levels (~£12bn per year) by the 2030s. This decline was identified as a substantial risk to the sustainability of the public finances by the OBR in its 2025 Fiscal Risks and Sustainability Report.

Revenue from cars is most at risk, because the EV transition for cars is the most developed across vehicle types, with cars also representing the largest proportion of fuel duty revenue. The eVED regime is intended to ensure all motorists will pay based on how much they drive

and this declining revenue base is replaced.

The government will implement eVED as an additional mileage-based add-on to VED for EV and PHEV cars, which is designed to replace the fuel duty revenues which will be lost as petrol and diesel vehicles are phased out over time. Other vehicle types, such as vans, buses, motorcycles, coaches and HGVs, will not be in scope of eVED upon its introduction in April 2028.

The government says this approach will protects motorists’ privacy as there will be no requirement to report where and when miles are driven or install trackers in cars. User-supplied mileage reporting and payments for eVED will be integrated into existing VED processes, to make complying with the new requirements as simple for motorists.

Exchequer secretary to the Treasury Dan Tomlinson said: “The transition to electric cars will improve our air quality, create high-skilled jobs and support our net zero goals. eVED will ensure this happens fairly and will also protect vital motoring taxation revenues for the long term.

“The government remains firmly committed to supporting the transition to electric vehicles. At Budget 2025, we have announced measures worth £3.6bn which will make electric cars and chargepoints more accessible and back our British automotive sector to build the electric vehicle models of the future here in Britain.

“The government will continue to take steps to ensure the transition to electric is successful, fair and fiscally sustainable. Through this consultation and wider engagement, the government wants to hear your views on eVED and how best to implement it.”

HM Treasury has launched a public consultation on the introduction of eVED that sets out detail on how the tax would work and seeks views its design and implementation.

Mileage estimation

New mileage estimation and reporting requirements, and payments for eVED, will be integrated into the existing VED system, to minimise administrative burdens for motorists. Integration with VED will means most motorists will only be required to interact with the system once per year and through familiar channels. VED is administered by DVLA, who will also administer eVED.

Alongside paying their VED each year, under eVED motorists will estimate their mileage for the year ahead, pay an upfront charge based on their estimate or spread their payment across the year, and then submit their actual mileage at the end of the year to trigger a reconciliation. Motorists will have their mileage checked annually.

The average EV driver drives around 8,900 miles per year and the average petrol and diesel driver drives around 8,000 miles per year, says HM Treasury suggests.

For new cars, as with VED, dealerships will have the option to pre-pay and bundle eVED mileage into the on-road price of a car. Alternatively, the vehicle owner will be able to make their own arrangements and estimate their mileage for the remainder of the tax period, for eVED purposes.

For existing cars, at VED renewal each year, motorists will be prompted to enter their vehicle’s mileage reading and then estimate their mileage for the year ahead.

Based on this estimate, an estimated annual eVED liability will be calculated by DVLA, using the applicable rate.

The mileage estimation process is designed to help motorists smooth payments over the year and reduce the likelihood of large balancing payments due at the end of the VED period. HM Treasury suggests the mileage estimation process will feel familiar to motorists who are already required to estimate their annual mileage for the purposes of car insurance. The government will publish guidance to help motorists to estimate their mileage, and how adjustments can be easily made at the end of the VED period.

HM Treasury sets out an example of a motorist who pays eVED monthly:

Mileage checks

Mileage data from cars is currently collected at annual MOTs and is available to see for a car on GOV.UK. The government intends to use this data to ensure that user-supplied mileage is consistent and up to date, so if a car is already subject to an MOT, there will typically be no additional steps for checks.

Cars under three years old are not currently required to have an annual MOT. The government currently intends for these cars to attend an additional mileage check at an accredited provider around their first and second anniversary, but welcomes views on whether these additional checks should be required. For many motorists, this will be able to be combined with other routine servicing and safety checks that their vehicle will typically require in this period.

The government considers MOT test centres to be well placed to be these accredited providers. They already have facility to record mileages and are trusted partners of government. There will be no motorist charge for these additional checks, which will be funded by the government. The government will engage with the industry on these arrangements.

The government says it will strengthen the approach to capturing mileages at MOT (and for the period prior to the first MOT). This will include considering the methods accredited providers could use to efficiently and reliably extract mileage data from cars, thus reducing scope for human error from writing down numbers from the vehicle display.

International mileage

Because the government has ruled out charging tax based on when or where people drive, to protect motorists’ privacy, mileage driven overseas by UK registered cars will fall into scope of eVED, as with fuel duty, which does not vary on basis of where a car is driven.

The government recognises that motorists based in Northern Ireland may be more likely than motorists based in Great Britain to drive outside of the UK. There is currently no equivalent mileage charge to eVED on electric or PHEV cars in the Republic of Ireland, however the government says it will monitor the international tax landscape.

Enforcement and penalties

Non-payment of the eVED will be penalised, says HM Treasury. DVLA deploys a range of enforcement measures for VED, including reminder letters in some circumstances, up to penalties, court prosecutions and fines. Action is taken based on evidence from the vehicle record and following sightings of unlicensed vehicles on road by automatic number plate recognition (ANPR) cameras, police and local authorities. Further enforcement activities include the use of stickers, wheelclamping, vehicle lifting, and impounding to deter and penalise non-compliance.

The consultation runs until 18 March 2026. It is hosted on an online survey platform called SmartSurvey.

TransportXtra is part of Landor LINKS

© 2026 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020