Almost 4,000 new electric chargepoints were installed across Britain during the third quarter of 2025, new figures from Zapmap reveal.

The chargepoint mapping and data service reports that 3,928 new chargepoints were installed in Q3 2025.

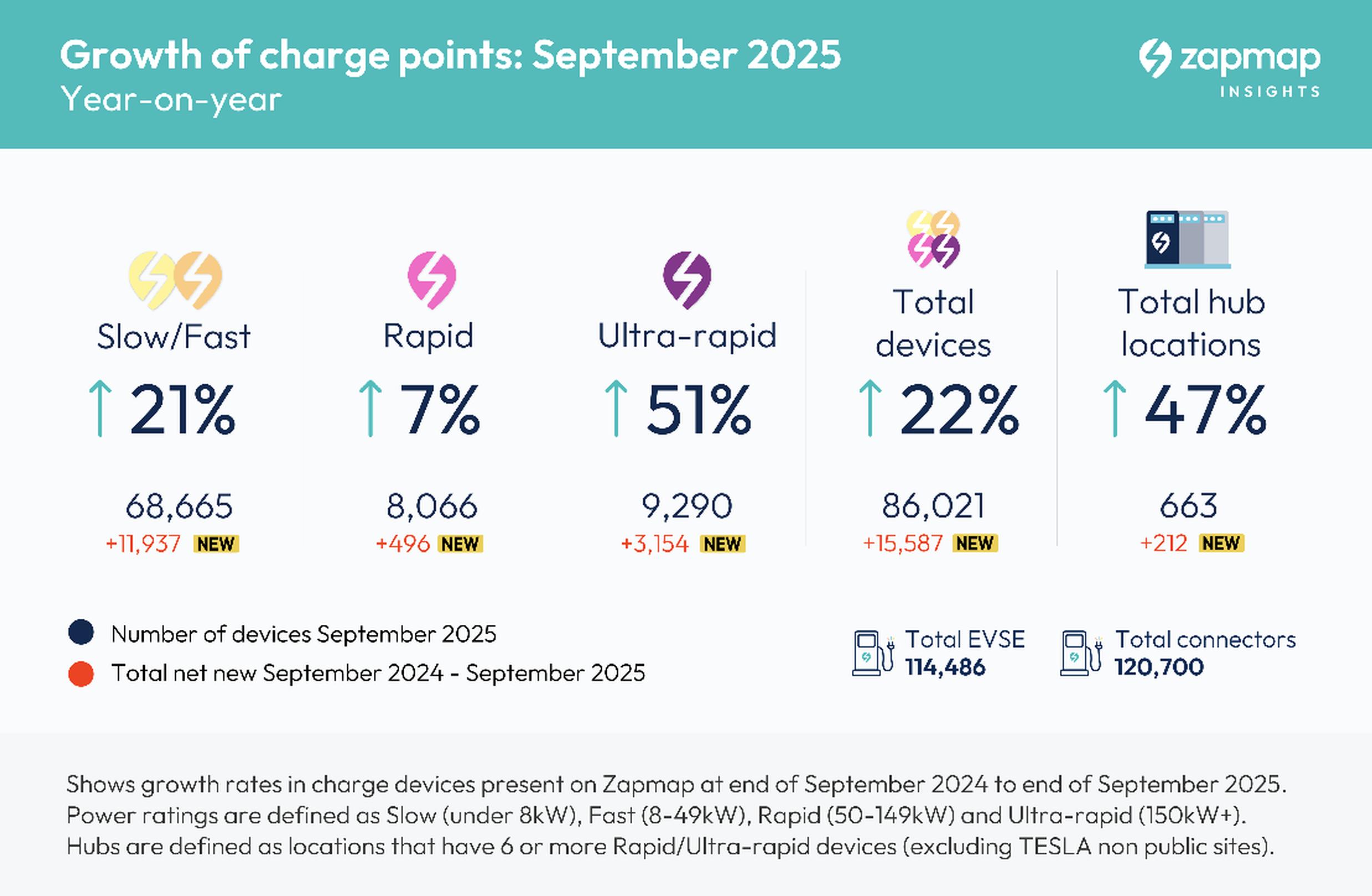

The EV charging infrastructure now encompasses 86,021 devices (114,486 EVSEs) at 43,507 locations, a year-on-year increase of 22%.

Ultra-rapid devices, delivering charging speeds of 150kW and above, continue to show the highest growth. There are now 9,290 chargers in this power band, 51% more than in September 2024.

There are currently 663 charging hubs across the country (defined as six or more rapid or ultra-rapid devices at a single location) with 212 of them installed over the past 12 months.

Hubs are typically popular with electric car drivers, especially to support en-route charging on longer journeys, and are also beginning to show the future direction for the EV infrastructure, with faster charging times, an increased focus on sustainable energy systems and locations which deliver enhanced amenities.

Significant new hubs since Zapmap’s last quarterly update include:

Zapmap’s statistics show progress in the regional distribution of high-powered chargers this year: of particular note, the North West has seen 38% year-on-year growth in high-powered chargers, followed by Yorkshire and the Humber, at 33%.

Across all power bands, the South-East and Wales showed the highest year-on-year growth, at just over and just under 26% respectively.

Destination charging, where people charge when stopped, rather than stopping to charge, covers several use cases. For those cases with a sub-four hour dwell time, such as gyms and supermarkets, Zapmap says it continues to see a shift towards rapid/ultra-rapid chargepoint installations.

Developments over the past quarter include a collaboration between Zest and the North East Combined Authority, funded through HM Government’s Levelling Up Fund and the On-Street Residential Chargepoint Scheme (ORCS), to deliver 40 new EV spaces across 18 sites with speeds of up to 150kW at key destinations, including town centre car parks, coastal sites, country parks, and leisure centres.

Joint research undertaken by Zapmap and the RAC during Q3 shows that, of the total number of EV chargers installed at supermarket locations in the last 18 months, 596 were rapid or ultra-rapid. This means that almost 60% of all supermarket EV locations now offer higher-powered charging facilities.

Lower powered charging devices continue to represent the largest tranche of the infrastructure, providing charging for longer stops and top-ups, such as in car parks and at tourist attractions. Some 68,665 chargepoints are currently defined as low-powered (slow/fast chargepoints powered at <50kW), representing just under 80% of the total.

On-street charging devices, also falling within the lower powered grouping, and designed for overnight charging, are aimed at drivers who wish to charge close to home but do not have off-street parking. These chargepoints have seen 2,336 new additions in Q3 bringing the total to 31,593.

The capital continues to lead the way on both EV adoption and near-home charging, with the majority of these chargers (22,871) located in Greater London. Meanwhile the growth in on-street provision throughout the rest of the UK is 31% year-on-year.

The first LEVI (Local Electric Vehicle Infrastructure) funded chargepoint, installed by char.gy and Brighton & Hove City Council, went live on Zapmap in September, marking a key milestone in the delivery of the scheme, designed to ensure equitable access to near-home charging, particularly in areas where off-street parking is limited. There are currently 52 LEVI funding projects approved for delivery, 19 of which are currently open to tender.

Jade Edwards, head of insights at Zapmap, said: “In the past three months, we’ve seen sizeable investments into the industry from both Westminster, through a £63m allocation under the Plan for Change, and the Scottish Parliament, through a £6.3 million allocation to Local Authorities in the south of Scotland.

“In addition, both parliaments have extended practical support for cross-pavement charging solutions and incentives for EV buyers in the form of the government Electric Car Grant Scheme and the continuation of Transport Scotland’s interest-free loan. Meanwhile both GRIDSERVE and Osprey secured funding to support their continued growth.”

“Two particularly insightful reports released in September highlight areas that still need focus to support both demand- and supply-sides: Charge UK identified the factors contributing to the high cost of public charging, while char.gy, alongside YouGov, demonstrated the positive impact that addressing misinformation would have on those who are currently deterred from switching to an EV.

“While 2024 was a year of rapid growth, 2025 is shaping up to be a year of evaluation, with both the public and private sectors giving thought to the long-term shape of the EV market.”

TransportXtra is part of Landor LINKS

© 2026 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020