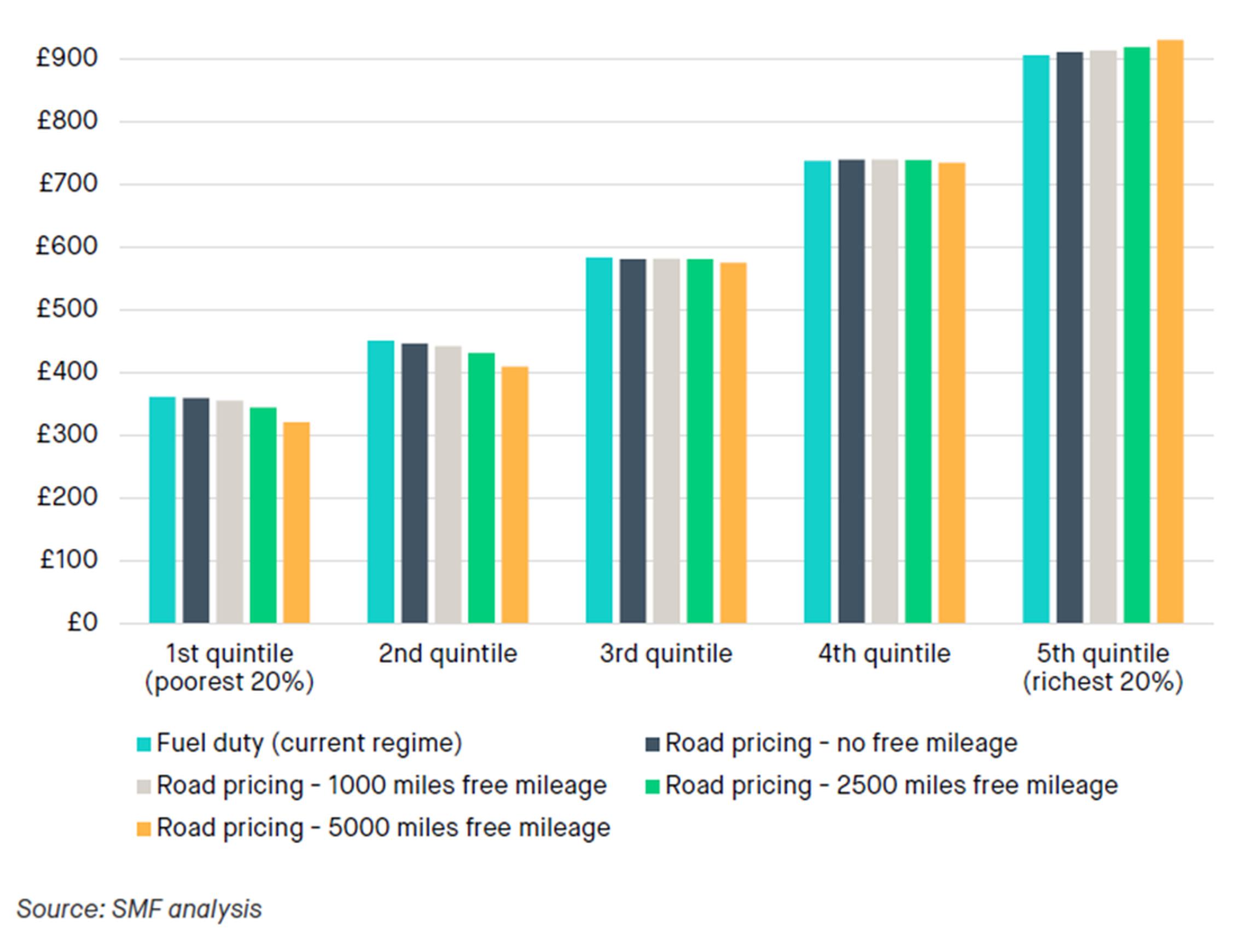

Charging motorists a levy based on the miles they drive would be fairer and more popular than the current fuel duty regime and could even help address the cost of living crisis, suggests an influential UK think-tank.

In a report endorsed by Lord George Young, a former transport secretary, the right wing Social Market Foundation (SMF) said that a new road pricing system is urgently needed to make transport policy more fair and fiscally sustainable.

The growth in electric vehicles,...

+93% more

TransportXtra is part of Landor LINKS

© 2026 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020