Those at the leading edge of thinking and innovation will know from recent conferences, editorial commentary and political agendas, that a current major industry focus is on addressing Urban Mobility in its widest sense. This is an area offering huge potential in terms of both creative service and system development, and customer benefits. We must expect a paradigm shift towards intelligent urban and transport planning. It will be a key focus of the forthcoming Travel 2020 conference and exhibition and it may be helpful to summarise this new connected way of thinking, and to build a clearer picture of what to expect from our automotive and transportation infrastructure by the end of this decade.

Key trends are setting the scene. In 2010, for the first time, over 50% of the global population were living in cities. This ‘urbanisation trend’ is not going to reverse; in fact, over 60% of the population will live in cities by 2030, and up to 70% by 2050. This poses urbanisation externalities, both positive and negative, with strong congestion and associated pollution being the key challenges.

Also, we are seeing interesting changes in the current vehicle ownership approach; Frost & Sullivan predict that of the top 20 mega cities globally, Tokyo, London, and New York are set to see a reduction in vehicles per 1000 population between now and 2025, the highest decline being from 400 to 340 vehicles per 1000 in London (15%). Attitudes and social trends towards car ownership are changing: Generation Y consumers are less inclined to own a car, and are finding the cost of ownership prohibitive. Equally, they’re faced with important choices between, say, transportation, and connectivity, through smart-phones, social networking, and the era of geo-socialisation. In some cases, this is even replacing the need to travel at all.

Such advances in technology are set to facilitate integrated and smart mobility solutions, whilst leveraging the existing infrastructure with new concepts and business models. Such examples are arising from synergies across the complete mobility ecosystem, including real time information, location based services, and booking and payment options on the one hand, through to eMobility, and new service offers like Car Sharing (Car Clubs), Bus Rapid Transit and Personal Rapid Transit (PRT) on the other.

In the automotive sector, this is not something that has gone unnoticed by vehicle manufacturers, with a number of vehicles being launched towards addressing the Urban Mobility requirements of tomorrow. For example, Indian company Tata Motors introduced the low priced Nano to address primarily the cost issue of owning a vehicle in cities. Nissan have launched the Leaf, the first all-electric ‘production car’, whereas BMW are devising the Megacity vehicle that is reported to be available in 2013 to allow a more compact vehicle to be practical to their customers without compromise on telematics, entertainment, and connectivity. Indeed, many manufacturers are looking to provide smaller vehicles to target city dwellers, without reducing the kind of comforts that they have come to expect on existing models, coupled with the level of connectivity they expect at home. That said, consumers are starting to see the burdens of tax, insurance, parking and congestion charging, servicing, and other associated automotive requirements and costs a hassle, giving rise to alternative solutions that remove them from the individual owner, such as car sharing, but also ideas like the Peugeot Mu, which integrates travel from across different modes, and advises on the best available option to customers, coupled with a loyalty scheme depending on user preferences. Clearly, we are seeing a shift from cities being designed around cars, to cars designed around cities. The automobile industry recognises it is no longer just in the business of manufacturing and selling vehicles, but beginning to offer a complete mobility provision.

For further information about the Travel 2020 conference and exhbition visit: www.Travel2020.com

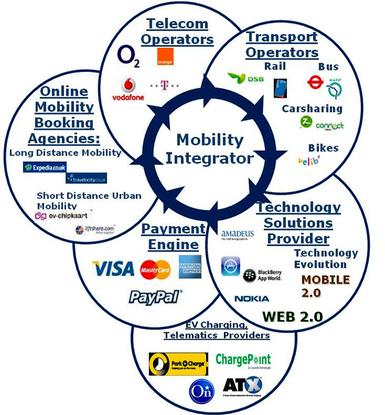

Several complete transport solutions already coexist across different modes of transportation. We are seeing the emergence of a new business model in the form of a Mobility Integrator, providing a smooth and convenient integrated mobility platform; the Peugeot Mu being an early example. This focuses on incorporating all of the key stakeholders in the provision of travel and mobility services, specifically transport operators, technology solution providers, online booking agencies, telecom operators, payments handlers, and increasingly Electric Vehicle and Telematics providers. This gives rising importance to the hitherto neglected ‘first and last mile’ connectivity on journeys, that can have a very significant influence on modal choice.

However, and even more interestingly, the kind of changes we are seeing in urban mobility are not purely dictated by customer preferences. Cities are seeking to define themselves as having created a ‘smart mobility’ offer. The leaders are most likely to adopt integrated multi modal solutions with supporting infrastructures such as Bus Rapid Transit, Metro, bus/cycle lanes, and electric vehicle incentives, whilst enforcing congestion/road user charging, emissions standards, and parking controls. The belief is that consumers will always change their travel behaviour where a better alternative is available, but this must be objectively quicker and more cost effective, providing the same level of confidence, utility, security, and connectivity that can be found on more traditional modes, and of course easy to navigate and pay for.

Payment systems are playing a key role in mobility integration already, and there are a number of particularly interesting opportunities that are only just being brought to fruition. In terms of smart cards, it is easy to look at schemes such as the Octopus card in Hong Kong, introduced in 1997 and now used by over 95% of the 16-65 year old population, or the Oyster card in London, now accounting for over 80% of bus and tube journeys, and assume these models should simply be replicated elsewhere. However, the real benefit in going forward is linking them beyond just one city, and beyond just transportation.

Much has been made of Near Field Communications (NFC) payments via the use of mobile phones recently. With the rumours of many smart phone providers adopting this in their forthcoming models, it could provide a significant opportunity for consumers and operators alike to embrace an existing technology via new platforms.

The final piece of the jigsaw to raise in a discussion on the future of urban mobility is Real Time Information. Increasingly, operators and passengers alike are able to check on the status of service of their chosen transport mode, and to react accordingly, be it through changing route, or even by changing mode. The technology provides passengers (of all modes of transport) with updates and informed mode choice, but perhaps more importantly to operators, a wealth of information regarding ticketing, patterns of movement, scheduling against performance, incident management, and links to roadside infrastructure for traffic management purposes. Some systems providers are even arguing now that real time is too late, and that many disruptions can be predicted prior to the event occurring, particularly in the case of the road networks. Therefore, by 2020, we are likely to see integrated active traffic management providing pre-time information.

There is clearly an incredible opportunity to combine thoughts and experiences, and maximise the urban mobility mix in tomorrow’s smart cities. The immediate challenge is getting comprehensive stakeholder participation and acceptance across the modes, and in the longer term a willingness to standardise and harmonise the number of platforms on which these systems rely. This not only provides economies of scale, but allows further interoperable transport systems to develop, which is where many of the benefits lie.

We have to now see the future of Mobility being driven primarily by connectivity: where all modes of travel are integrated and interoperable, allowing passengers to make informed judgements via the touch of their smart phones, and the operators to have seamless communication between systems. This is exactly the kind of solution and ideology that will be demonstrated at Travel 2020. I invite you to join me at Frost & Sullivan’s workshop on Day 1 to further explore the exciting potential!

TransportXtra is part of Landor LINKS

© 2025 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020