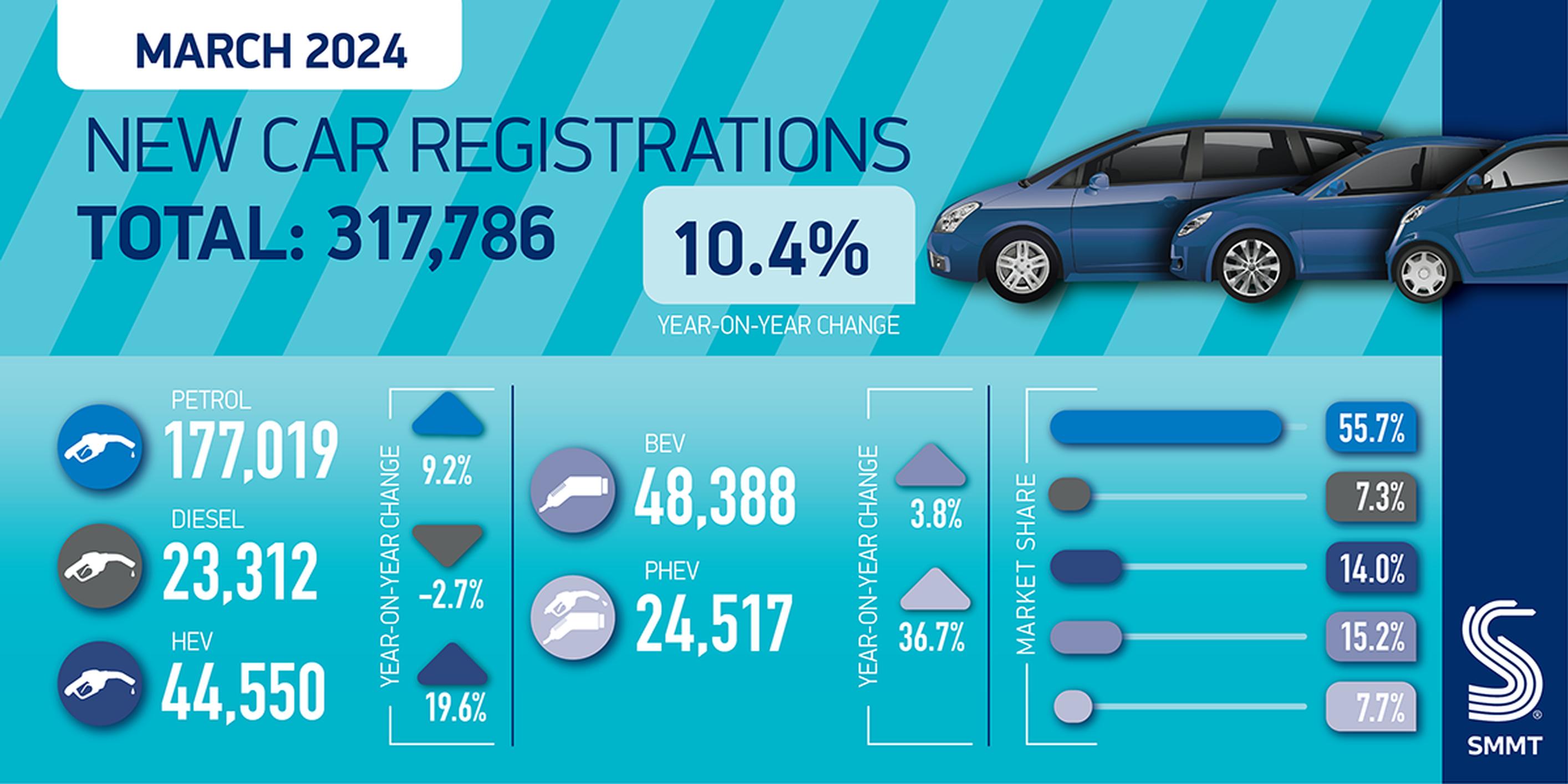

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in registrations. In what is typically the busiest month of the year due to the new numberplate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still -30.6% below pre-pandemic levels.

Growth was again driven by fleet investment, up 29.6% as the sector continues to recover following the constrained supply of previous years. Registrations by private buyers fell by -7.7%, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates. The small business registration segment, meanwhile, declined -8.0%.

Petrol cars retained the lion’s share of the market, at 55.7%, with registrations up 9.2% year on year, as diesel volumes fell -2.7% to account for just 7.3% of demand.

Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14.0% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations. Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%. Registrations rose 3.8%, with only fleets showing any volume growth.

The Society of Motor Manufacturers and Traders (SMMT) says the fall in BEV market share within a growing market underscores the need for government to support consumers to speed up fleet renewal. Large fleets continue to drive BEV uptake, thanks to compelling tax incentives but while registration volumes increased in March, market share declined. A tough economic backdrop makes it ever more challenging for consumers to invest in these new technologies.

Manufacturers themselves are offering generous incentives, helping more drivers switch to zero emission vehicles and deliver government and industry carbon targets, but this cannot be sustained indefinitely. The SMMT argues that full market transition needs incentives not just for fleet and business buyers but private retail buyers as well, something that would bring the UK into line with other major markets. Temporarily halving VAT on BEVs, revising the threshold for the expensive car supplement on Vehicle Excise Duty next April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT rates to 5% in line with home charging, would make a significant difference to consumers, helping more of them move to zero emission vehicles sooner.

Mike Hawes, SMMT chief executive, said: “Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead. Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

Ben Nelmes, CEO of New AutoMotive, said: “It's great to see another 44,000 people opting for cleaner, cheaper transport by switching to an electric car. With electricity prices falling, the potential running cost savings of going electric are only going to get bigger, making going electric more attractive for people who do the most miles. The fact that companies are a little behind on their targets means we are likely to see improved marketing of electric cars, and growing discounts on some brands. Ministers should work with manufacturers to combat misinformation about electric cars to turn those targets into reality.”

Ian Plummer, commercial director at Auto Trader: “Sales of electric vehicles are still rising, despite the gloom from Tesla earlier in the week. While the fleet side of the market is driving the growth, more needs to be done to stimulate electric vehicle demand among private buyers where affordability remains the #1 barrier.

“That said, manufacturers are fighting harder than ever to tempt customers, as more than three-quarters of new EVs are now advertised on our website with discounts, with the average discount applied increasing to 11% last month. That trend only looks set to accelerate as manufacturers struggle to meet strict ZEV mandate targets in a much more competitive landscape.

“The arrival of new Chinese entrants is likely to continue to shake up the market and bring down prices for consumers. Their share of new car advert views on our platform has more than tripled since March 2021. Underlying demand from consumers also remains strong after a record 89.1m visits to our website last month.”

Ralph Palmer, electric vehicle and fleets officer at Transport & Environment UK, said: “While it's good to see battery electric sales volumes are still on the rise, the real climate benefit of BEVs will come when they're increasing their market share to replace fossil fuel vehicles. While the ZEV mandate secures the long-term BEV market, we need to see more done to support car buyers make the switch in the near term too, particularly against the backdrop of years of squeezed household budgets, rampant misinformation and, frankly, inconsistent government policy and messaging.

“That will come in the form of genuinely levelling up charging infrastructure across the entire country; giving people confidence in the longevity of batteries and maintenance and repair services for BEVs; and investing in clear communications campaigns to ensure the public are accessing reliable information on what the BEV transition means for them, including the huge running costs savings they could benefit from.”

TransportXtra is part of Landor LINKS

© 2025 TransportXtra | Landor LINKS Ltd | All Rights Reserved

Subscriptions, Magazines & Online Access Enquires

[Frequently Asked Questions]

Email: subs.ltt@landor.co.uk | Tel: +44 (0) 20 7091 7959

Shop & Accounts Enquires

Email: accounts@landor.co.uk | Tel: +44 (0) 20 7091 7855

Advertising Sales & Recruitment Enquires

Email: daniel@landor.co.uk | Tel: +44 (0) 20 7091 7861

Events & Conference Enquires

Email: conferences@landor.co.uk | Tel: +44 (0) 20 7091 7865

Press Releases & Editorial Enquires

Email: info@transportxtra.com | Tel: +44 (0) 20 7091 7875

Privacy Policy | Terms and Conditions | Advertise

Web design london by Brainiac Media 2020